Money Advice Money and Budgeting for Teenagers

As a teenager we understand that budgeting is probably the last thing you’re thinking about. It’s not exactly cool or interesting, right?! Well, whilst we totally understand where you’re coming from, just hear us out.

Budgeting is an important lifelong skill which everyone should master. You might not think it’s relevant to you now but it’s a vital skill that every adult needs in order to be financially responsible and good with money.

Why should I budget as a teenager?

There are loads of reasons why people should budget but here’s some great reasons why you should start budgeting now:

- Creating a budget helps you learn the difference between needs and wants. Just to clear this matter up; “needs" are the things which enable you to live – food and drink and a roof over your head being the main priorities. “Wants” are the non-essentials – the things that make life more enjoyable, but we could live without. More about this later!

- To budget, you need a source(s) of income. As a teenager, this may come in the form of pocket money or an allowance from parents. However, now is the perfect time to start earning an income.

- Getting into the habit of saving money. It’s never a good idea to spend everything that you earn, and a budget can help you develop the habit of saving a percentage of your income.

- Learn from your mistakes now. Everybody makes mistakes with money but if you learn from those mistakes now, chances are the consequences won’t be too overwhelming. But financial mistakes as an adult can have dire consequences so learning to manage a budget whilst you’re young is an absolute must!

On board? OK. Here’s how to create a budget:

Even if maths is your worst subject at school, creating a budget is simple – particularly if you’re a teen who doesn’t have too many responsibilities. It’s simply the process of balancing your income and expenses – and ensuring that your expenses don’t exceed your income.

- Firstly, make a list of your income. Make sure you include all the money you receive including any allowance you might get from your parents, as well as any income from jobs that you might have.

- Next, you need to list all your expenses – and you need to be honest! You might have expenses that you have to pay such as your mobile phone. Though as a teenager, it’s more than likely that most of your expenses are non-essential, we’re guessing?! Things like after school drinks and snacks, make-up, cinema trips, etc?! And that’s fine – just make sure that you list everything you’re spending money on! Don’t forget about the school holidays, when you’re likely to spend a bit more than usual!

- Finally, you need to do a quick calculation. If your income is more than your expenses, brilliant! You have a healthy budget and manage it well. However, if you’re spending more than your income, you have a problem. You’ll need to cut back your expenses and learn to live within your means.

Now, here’s what you really need to know about budgeting so listen up! Budgeting isn’t about restricting how much you can spend or what you can buy. It’s just about managing the money that you have well. If you can learn to do this before you become totally financially independent, you’ll be well prepared when you leave home and become a responsible adult with your own bills to pay!

Building savings and why it’s important

An important element of a healthy budget is savings. If you can develop the habit of saving now as a teenager, the chances are that you’ll continue to save as an adult.

So when you’re writing your budget and listing your expenses, try to include savings and view it as something you have to spend. However, rather than spending the money, put it away separately from your other money. Even if it’s a few pounds every month, it will quickly add up.

This is the difficult bit about saving. Try not to dip into your savings. They should be seen as long-term savings, to help you in the future – perhaps if you go to university or when you buy your first house. You should try to resist dipping into savings just because you’re low on cash!

Compound interest – how does it work?

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it.

If you’re not yet convinced that saving is for you, let’s talk about compound interest.

When you start saving money, you’ll also start to earn interest on that money. Different accounts pay different levels of interest so it’s important to look around to try and get the highest interest rate that you can.

Compound interest is earned on both the original amount plus the interest already earned. If you’re confused, don’t worry. Let’s take a look at an example.

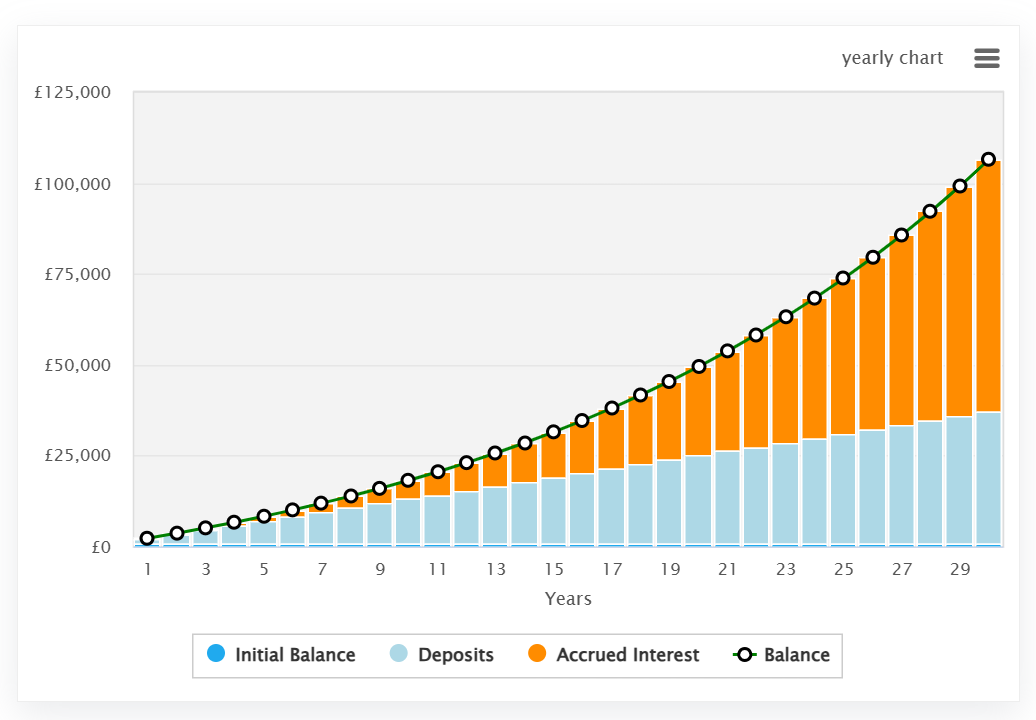

Let’s start by saying you’re going to save £1000. The interest rate is 6%. We are going to use 6% for this example to keep it simple but in reality, the average return on a stock market over the last 30 years is 7%.

If you just left that money and came back to it in 30 years, it would be worth £6022.58.

That’s pretty good but wait. You’ve not seen the magic of compounding yet!

Let’s say you decide to add £100 per month to your initial £1000. Every month for the next 30 years – a long time we know but just stay with us! (This is how pension funds work – you pay in a little every month and it compounds)

By the time you reach your parents age, your original £1000 will be £106,474.08.

How cool is that?!

It’s important you understand that compound interest is a long-term thing but that’s why we’re telling you about it now. The sooner you start putting money aside, the more you’ll reap the benefits of compound interest.

Saving suddenly seems much more attractive, doesn’t it?! The orange section, that is the compounding working its magic and it just gets better and better with time.

Understanding Credit Cards and how to use them

You won’t be able to apply for a credit card until you’re 18 (In the UK) but it’s pretty important that you understand what they are and the best way to use them now.

When you use a credit card, you’re essentially making purchases with the Bank’s money. Your bank will put a spending limit on your credit card, but you will have to pay the bank interest for borrowing their money.

If you pay your credit card off in full and on time, you won’t pay interest for borrowing the money. However, if you leave a balance on your credit card, the bank will charge you interest. For example, let’s say you spend £200 but you forget to pay it off before it’s due. If the credit card has an APR (annual percentage rate) of 24%, your balance will increase by 2% (24/12) at the end of the first month and then 2% of the total at the end of the second month, compounding against you.

Credit cards can be useful for purchases above £100 because if there is an issue with the purchase or the company that you purchase it from, your credit card provider can provide protection. However, it’s really important that you’re able to pay the balance off in full to avoid interest charges as just like compound interest, they will accumulate very quickly.

So please think carefully before you apply for a credit card, especially if you’re a student without a regular income.

Be smart and protect your money

We don’t want to nag but this really has to be said. It’s really important that you become wise to scams in order to avoid becoming a victim of fraud. The following tips should help keep you and your money safe:

- Never share passwords or pin numbers and be careful about sharing personal information like your address and date of birth. When you do share such information, make sure the organisation you’re giving it to is reputable and is taking the information for a legitimate reason. If you’re unsure, wait. Don’t give any information unless you know it’s safe to do so.

- Don’t share ANY personal information on social media and always set your accounts to “Private”. Fraudsters use social media to gather information about you so don’t give it to them. Avoid replying to posts which ask about your first pet or your middle name – these are often people fishing for information.

- Remember that your bank will never phone you. So hang up immediately on calls claiming to be your bank and never confirm your pin or personal details. If you’re unsure, ask a parent/trusted adult or call your bank to check.

- If you get emails or text messages with links in them, be wary about clicking on anything or responding in anyway. A big giveaway might be poor grammar and spelling – fraudsters aren’t that conscientious! Common scams include messages about parcels being delivered and payment due for unknown items. If it looks suspicious, it probably is. If you think it’s from a legitimate company, you can check with them to make sure.

- If it seems too good to be true, it is probably a scam.

Preparing for Student Life

If you’re thinking about going to university, managing your own money and making your student loan stretch. will be really important. You’ll need to learn how to budget as a student. but remember that everyone makes mistakes with money along the way. If you do, don’t beat yourself up too much. The best advice we can give is to ask for help if you’re unsure.